With a population of almost 228 million people in Nigeria, hope is a prerequisite to survival and as the saying goes, no one who wants to be successful has fear of taking risks.

Seeing the desperation in the country for getting rich quick, Ponzi schemes stem up every fortnight. From MMM, to MBA Forex and the latest being CBEX.

CBEX claimed to be a global platform, linked to a government-owned business in China called Beijing Equity Exchange. The company emerged in Nigeria around July 2024, with a rented office in Ibadan, Oyo State.

How CBEX operated

According to Mariblock’s analysis, Users get a wallet address to deposit into as soon as they register. The figures they deposited are then shown on their individual dashboards.

Some investors claim that the referral bonus as part of the requirements is what should have given it away as a Ponzi scheme but the testimonials from friends and family were very convincing.

According to more reports, on the back end, CBEX moves the deposited funds to other wallets via the TRON blockchain. The assets are routed again through several wallets and smart contracts before finally getting swapped into ethereum (ETH) and sent to centralized exchanges for withdrawal.

Why Users Deposited

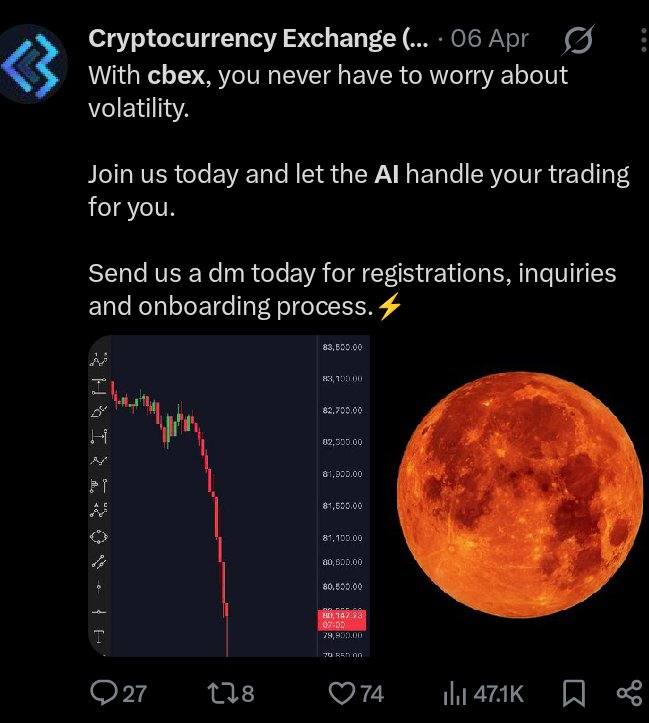

CBEX was marketed as a trading bot. The crash has raised lots of questions, many investors say the platform did not initially appear to be a Ponzi scheme because it capitalised on the use of artificial intelligence (AI).

Unlike other investment platforms, CBEX didn’t promise a fixed monthly return on investment. From the Foundation of Investigative Journalist’s report, investors depended on an AI trader called “Hosting”, that traded twice daily and promised a certain amount of profit.

Investors could also withdraw their profits after 30 days, but the typical withdrawal window was within 45 days. Following the new wave of Artificial Intelligence, a lot of people were gullible to this new trading mechanism.

Some Finance YouTube creators, as early as February, had made videos warning that there was no trading bot that would give back 100% Return on Investment.

Social Media Influencers That Promoted The Scam and Nigerian Government’s Reaction

The Security and Exchange Commission Nigeria (SEC), published the Proposed New Rules and Amendments in December, 2024. The new law is aimed at restructuring the operations of Crypto social media influencers.

The law says that crypto influencers must announce to their community when they are paid to promote a digital asset or a service. Failure to follow this new law would attract a fine of N10 million naira and a 3 years jail term.

Meanwhile, the Investments and Securities Act (ISA) also stipulates a jail term of 10 years or a fine of N20 million for promoters and operators involved in pyramid schemes or Ponzi schemes.

Following the latest CBEX fraud, the Economic and Financial Crimes Commission (EFCC) and SEC are partnering to expose some influencers that backed the project.

Some of the tiktok influencers, as reported by FIJ, includes,

- Atiinukeh, also known as Fatima, who had over 10,000 followers on the platform and over 60,000 likes.

- Babydee, with over 2,000 followers and 72.2k likes, made multiple posts promoting CBEX all of which are no longer available on the app.

Influencers on other social media apps, like X can not currently be identified as their promotional contents are no longer available.

On April 9th, @letter_to_jack had tweeted about an investment platform heard that gives 100% of your initial deposit. He had called it a ponzi scheme and said it was better people used their money to play bets.

The post garnered a million views and over 500 comments of people arguing that he should let others use their money for whatever they wanted.

How Victims Are Taking The Loss

Byteonchain.news reached out to a victim of the CBEX scam who said he didn’t want to talk about the loss. He however confirmed that he had lost almost $1,500 from the scheme.

The total amount of money lost from this scam is estimated at 1.3 trillion naira and affecting over 800, 000 persons.

It is reported that after CBEX stopped investors from withdrawing, they claimed they would roll out profits for the next five days. The pause was to enable them to eliminate scammers from the site, CBEX told investors.

On the presumed date of resumption for withdrawals, they finally told investors to pay $100 for KYC verification.

Although the loss lies heavy, some social media users have urged others to treat the “Influencers intent” with caution as some may have been victims of the CBEX’s deceptive legitimacy.

The lack of financial literacy and economic hardship in Nigeria continues to amplify these schemes.