Metaplanet Inc., a publicly traded company that focuses on Bitcoin, blockchain, real estate and Web3 based in Tokyo, Japan, announced on 23rd December, 2024 that it has acquired 619.70 BTC as part of its ongoing Bitcoin Treasury Operations. The acquired BTC is worth ¥9.5 billion and less than $60.7 million.

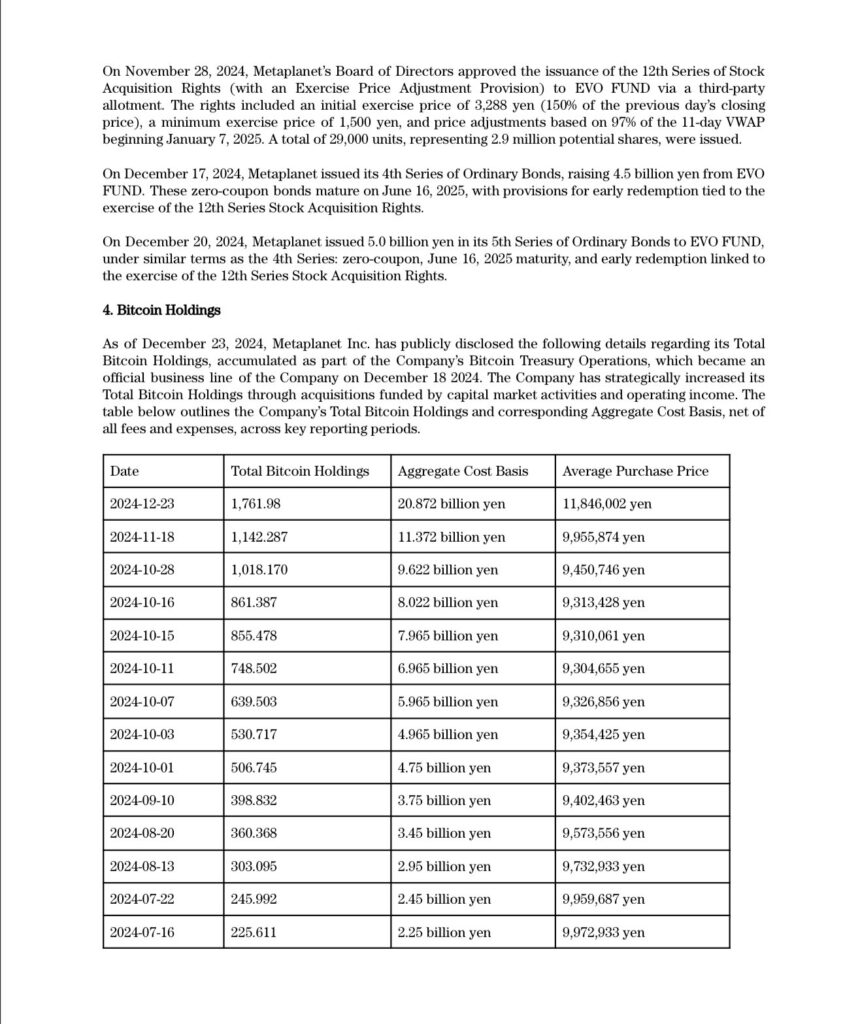

With Bitcoin trading at $96,000, Metaplanet Inc., has achieved a Bitcoin yield of 309.8%. This last purchase has increased their total Bitcoin Holdings to a total of 1,761.98 worth about $168 million, with an average purchase price of around $75,600 for each Bitcoin.

Metaplanet latest buy is the largest it has made since it acquired the cryptocurrency in May, 2024. It has also quadrupled the value of its previous record buy of 159.7 BTC on 28th October, 2024, making its Bitcoin stack the 12th-largest amongst public companies, leaving them directly behind medical tech maker, Semler Scientific.

Google finance records that Metaplanet’s Stock has gone up by 5% on the Tokyo Stock Exchange following the announcement of the BTC purchase.

BTC yield is a key performance indicator (KPI) that reflects the percentage change in the ratio of total bitcoin holdings to fully diluted shares outstanding over a period. According to Metaplanet Incorporated, it uses BTC Yield to assess the performance of its Bitcoin acquisition strategy, which is intended to be accretive to shareholders.

The Company believes that this KPI can be used to supplement an investor’s understanding of the Company’s decision to fund the purchase of Bitcoin by issuing additional shares of its common shares or instruments convertible to common shares.

While employing this strategy, they acknowledge the nuances and limitations behind using the BTC yield as a KPI, such as its inability to account for debts and other liabilities involved. In their words, “this KPI is not intended to be, and should not be interpreted as, a measure of operating performance, financial performance, or liquidity.”

Furthermore, Metaplanet adds that the market price of their common shares is influenced by many factors beyond the number of Bitcoin they hold and the number of actual or potential shares outstanding.

It is worthy to note that Metaplanet Inc., has not yet issued any convertible bonds as part of its Bitcoin Treasury Operations.