Buckle up, crypto fam—because the blockchain just hit the turbo button, and yesterday’s whirlwind of news has us all reeling from pure adrenaline! From privacy coins exploding like fireworks to legacy finance dipping its toes into the 24/7 crypto pool, the market’s serving up a feast of highs, hacks, and hype. If you blinked, you missed the plot twists that could rewrite your portfolio.

Let’s dive into the chaos: seven seismic stories that screamed “Web3 revolution” louder than a bull run siren. Don’t worry, I’ve got the deets—vibrant, unfiltered, and ready to make your FOMO explode.

$ZEC Soars 250% on Surging Privacy Demand—Is Anonymity the New King?

Holy privacy panic, Batman! Zcash ($ZEC) didn’t just pump—it detonated with a jaw-dropping 250% surge in the last 24 hours, catapulting its price into the stratosphere amid whispers of a global crackdown on traceable transactions. As regulators worldwide tighten the screws on KYC overload, savvy traders are flocking to ZEC’s shielded transactions like moths to a zk-SNARK flame. Is this the dawn of a privacy renaissance, or just whales playing 4D chess? One thing’s clear: if you’re not stacking ZEC, your coins might as well be wearing neon “Track Me” signs. Volume’s through the roof at $2.5B—get in before the shields drop!

CME to Launch 24/7 Crypto Derivatives in 2026—Wall Street’s Clock Just Went Infinite Ding-ding-ding!

The Chicago Mercantile Exchange (CME), that old-school titan of trad-fi, is flipping the script by announcing round-the-clock crypto derivatives trading starting in 2026. No more “markets closed at 5 PM” nonsense—think Bitcoin futures, ETH options, and beyond, accessible 24/7 like your favorite DEX. This isn’t just a launch; it’s a seismic shift bridging TradFi’s iron gates to DeFi’s wild frontier, potentially sucking in trillions from institutional suits who hate missing the after-hours moonshot. CME’s CEO called it “the future of frictionless finance”—we call it game over for sleepy exchanges. Who’s ready to trade while the sun sets on fiat?

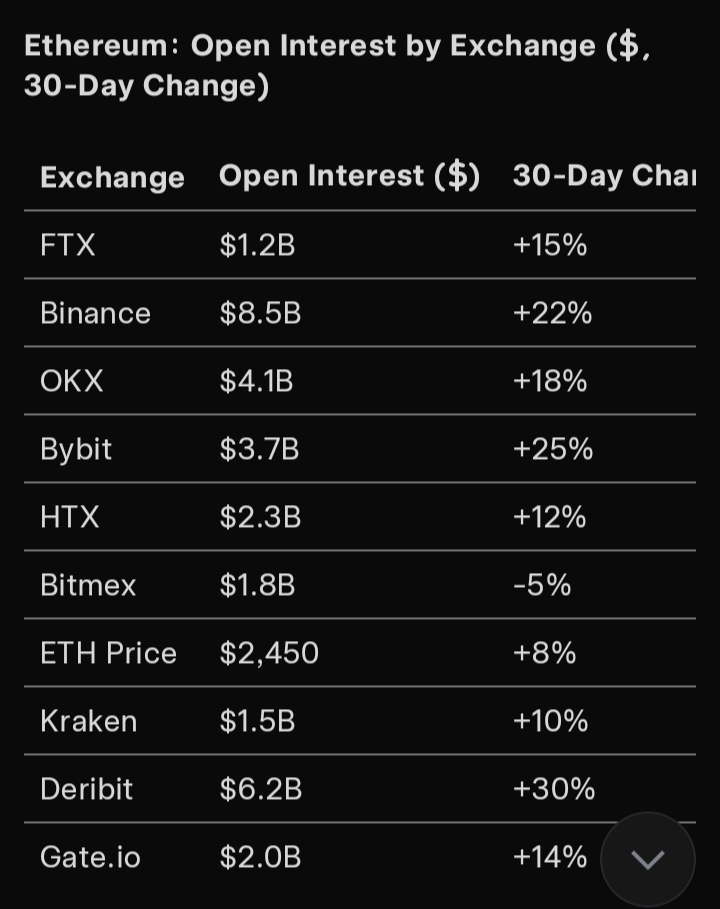

Decentralized Perps Hit $1.05T Monthly Trading—Perpetuals Party Goes Nuclear!DeFi just dropped a mic: decentralized perpetuals contracts smashed through $1.05 trillion in monthly trading volume, proving that on-chain leverage isn’t just alive—it’s thriving like a meme coin on steroids. Platforms like GMX, dYdX, and Hyperliquid are leading the charge, with slick UIs and sub-second executions luring traders away from CEX vampires. This isn’t hype; it’s hard data showing DeFi’s maturity, with open interest rivaling Binance’s glory days. As gas fees dip and L2s scale, perps are the beating heart of crypto’s $3T ecosystem.

Pro tip: If you’re not aping into these bad boys, you’re basically trading with training wheels—time to level up!

$AVAX Treasury Announces $675M SPAC Merger—Avalanche’s Avalanche of Ambition!

Avalanche ($AVAX) is swinging for the fences: its Treasury just unveiled a blockbuster $675 million SPAC merger with a yet-to-be-named powerhouse, injecting rocket fuel into subnets and gaming dApps galore. This isn’t your grandma’s merger—it’s a strategic nuke aimed at onboarding enterprise giants to AVAX’s high-speed chains, potentially exploding TVL by 300%. With $AVAX already up 15% on the news, whispers of RWA tokenization and AI integrations are swirling like confetti.

Emin Gün Sirer and crew are cooking something epic; if this lands, Avalanche could eclipse Solana as the go-to for scalable chaos. HODL tight—merger mania incoming! $21M SBI Miner Hack Laundered via Tornado Cash—Privacy’s Dark Side Strikes Again! Chilling chills down the spine: Japanese mining giant SBI lost a staggering $21 million in a brazen hack, with the pilfered BTC swiftly tumbled through Tornado Cash’s infamous mixer. Attackers exploited a firmware flaw in ASIC rigs, vanishing into the ether like ghosts in the blockchain. While Tornado’s zk-proofs keep the feds guessing, this heist spotlights mining’s soft underbelly—and privacy tools’ double-edged sword. SBI’s vowing “ironclad upgrades,” but the damage? A stark reminder that even behemoths bleed. Crypto’s wild west just got wilder—stay vigilant, miners, or become the next headline horror story!

Polymarket to Relaunch in U.S. After CFTC Clearance—Prediction Markets Unleashed! Freedom rings for oracles! Polymarket, the prediction market phenom that’s nailed elections and ETF bets with eerie accuracy, just scored CFTC greenlight to relaunch stateside after a regulatory rollercoaster. No more VPN shenanigans for U.S. degens—trade on everything from Fed rate cuts to meme coin pumps, all on-chain with real-money stakes. Volume’s already spiking 40% on the announcement, as co-founder Shayne Coplan hails it “a win for transparent markets.” With $500M+ in historical bets, this could balloon to billions. Prediction: Polymarket becomes the Bloomberg of Web3. Place your bets, America— the house always wins… or does it?ECB Partners with Firms on Digital Euro Fraud Tools—CBDC’s Battle Against the Baddies Begins!

Eurozone alert: The European Central Bank (ECB) is teaming up with Chainalysis and Elliptic to deploy AI-powered fraud detection for the incoming digital euro, aiming to squash scams before they sprout. As CBDC pilots ramp up, this toolkit promises real-time anomaly spotting and cross-chain tracing—think Fort Knox meets blockchain forensics. ECB brass called it “essential for trust in programmable money,” but skeptics cry “surveillance state 2.0.” With €1T+ in potential circulation, fraud-proofing isn’t optional; it’s do-or-die. Europe’s playing catch-up to crypto’s chaos—will this make the digital euro a fortress or just another traceable token? Whew—what a 24-hour fever dream! From ZEC’s privacy power play to ECB’s CBDC shields, crypto’s proving it’s not just surviving; it’s thriving in the spotlight. Keep your wallets warm and your eyes peeled—the next drop could be yours.Ethereum: Open Interest by Exchange ($, 30-Day Change)